Cover All Your Customer Diversification Bases to Ensure Maximum Price for Your Business

Whether you’re preparing to sell your business sometime in the future or think you’re ready to sell now, another key value driver to consider is customer diversification. To really get a feel for why it’s so important, ask yourself: what is the truest strength of your business?

Your customers. Everything else derives from your customers. Without them, you’d have no business. It’s not just about how many clients you have either. It’s also about both the percentage of clients who make up the bulk of your revenue and the diversification of those clients. What industry are you and your customers in? What geographical areas are they located in? Do you provide more than one product, process, or service?

The possibility of gaining access to new customers they may not have had otherwise and increased their market share is one major impetus for many potential buyers. So, of course, some of the first things they’ll look at is your customer percentage of revenue or profitability, and if your revenue comes from multiple sources rather than just your primary service.

If you want to draw top dollar from the sale of your business, consider taking the following steps to make customer diversification work to your advantage.

Analyze the Diversity of Your Customer Base by Percentage of Revenue

This is the crux of customer diversification. While a long-standing, solid rapport with a leading customer can reflect positively on the value of your company, a revenue stream concentrated on just one or a few customers can be a red flag for potential buyers. The risk is just too high. If just one or two of these customers walks away upon purchase, there goes most of the new owner’s revenue, so it’s worth your while to take the time to analyze your percentage of revenue per customer before you sell.

The best way to gain some insight into your customer diversity is to run a gross-revenue-by-customer-by-year report. This will show you at a glance the percentage of revenue each of your customers generates every year. You should aim to have no more than 10% to 20% of revenue coming from a single customer. An even more ideal goal is 5%.

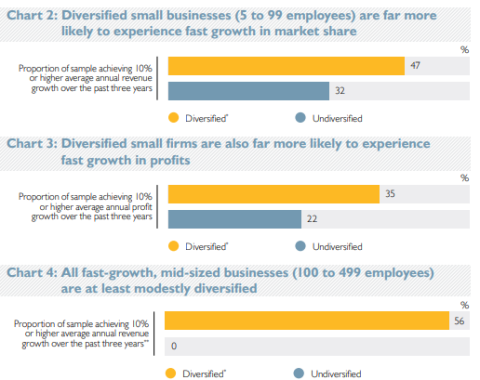

“7 out of 10 diversified firms achieved high revenue and profit growth in the past 3 years, compared to 2 out of 10 with customer concentration issues.”

That figure from the Business Development Bank of Canada underlines the importance of spreading out your customer revenue so a potential buyer doesn’t choose a company with a broader customer base, even if you do have increasing annual growth, improving profit margins, and a dozen other attractive figures.

Redirect Some of Your Business into Additional Revenue Streams

Not only is it important to expand your revenue over more customers, but it’s also just as important to branch out and spread your revenue over varied sources. While this could seem difficult at first and not what you visualized when you launched your business, it’s integral to the future success of both your company and the purchaser of your company. That’s why super conglomerates such as Johnson & Johnson are so successful. The BDC puts a potential buyer’s mindset into perspective:

While you’re working on diversifying, consider whether it’s possible to offer additional products, processes, or services, whether related or unrelated to your primary revenue source. If your business can render two or more services or sell two or more products, you can protect you and any potential purchaser from the very real possibility of becoming stale and unmarketable in the future, thus reducing risk as Peter Frumkin and Elizabeth K. Keating, authors of Diversification Reconsidered, attest:

"Business and nonprofit researchers have long argued that by establishing and maintaining multiple streams of funding…organizations are able to avoid excessive dependence on any single revenue source, stabilize their financial positions, and thereby reduce the risk of financial crises."

In that same vein, take a close look at the location of your customers. Are they all nearby or in the same country? A smart move to make before selling your business is to start exporting. Having some international customers on the books tells potential buyers your product, process, or service is globally attractive and that your business has what it takes to compete on an international scale.

“…diversified portfolios of investments outperform undiversified

ones for any given level of risk. Accordingly, in finance, diversification is usually considered unequivocally beneficial.”

Think of it this way: if your business operates in just one industry or sector, what happens when the economic conditions in that one industry go south? Having your business funneled into multiple unrelated industries buffers that impact, insulating you from the fallout and mitigating the risk for you and your potential buyers.

Having customers in multiple markets, local, regional, and international, reduces the risk involved for potential buyers, upping the value of your business.

Wrapping Up

After you’ve tightened up and organized your financial records, the next step to take when preparing to sell your business is to diversify your customer base, in more ways than one. Your customer base has a major impact on your company’s value in the marketplace, so it’s integral to create a solid customer foundation.

Start by analyzing your customer base by the percentage of revenue year by year to determine if you’ve spread your revenue out over a varied number of customers and ensure no customer, or just a few customers, equals more than 10% to 20% of your annual revenue. It’s even more preferable to make that number 5% to make your business appealing to buyers.

Keep your business from being unmarketable by offering more than one product, service, or process and branch out into one or more additional sectors or industries. It may seem difficult at first, but with a little creativity, you’re guaranteed to discover different uses for your product or a different service you could offer.

Finally, think about exporting. If this is new to you and a little daunting, consider taking one of the many free or low-cost courses through your local government or business group. International customers scream global appeal and continued revenue.

The bottom line here is it’s all about risk. The more customers you have, the more varied they are, the more realms you operate in, and the greater reach of your business all work in tandem to mitigate that risk for a potential purchaser at the same time as they increase the odds of your business’s success, both for you and your buyer.

To learn more about the importance of diversifying your customer base and other factors necessary to successfully sell your business, head to Muise Mergers & Acquisitions Inc., or send them an email with your questions. They can guide you safely through the selling process.