Utilize the Elusive Goodwill to Skyrocket the Value of Your Business Before You Sell

Because selling a business is so full of risk, if you want to get the most you can get out of the sale of your business, your best bet is to focus on value drivers. Value drivers are factors that define the success and worth of your business. Not all businesses have the same ones, nor do they have the same ones to the same extent, so concentrating on them can give you the edge you need to come out of the sale of your business with the best price.

Few value drivers contribute as greatly to the true value of your business as goodwill does. It reduces the risk of declining profitability and has become, by far, the largest asset of any business in recent years. In fact, a KPMG study shows that even back in 2010, more than 50% of the sale price of a business was due to goodwill alone. Those reasons alone are enough to make one company more valuable than another, similar business, offering justification for a premium price.

“…goodwill is the ability to generate more profits and cash flow than one would otherwise expect to, given the asset make-up of the business.”

Goodwill Reduces the Risk of Profitability Loss

The keyword when selling a business is a risk. The entire transaction is about the risk involved for the purchaser. Less risk equals a higher price. Goodwill is all about stability and consistency, laying a foundation of continued profitability for a purchaser. That makes your company a safer, more valuable bet than another. Even a company with fewer assets than another a purchaser may be eyeing can benefit from the goodwill they’ve built when it comes to selling their business simply because the goodwill helps mitigate any perceived risk.

So what does goodwill involve, exactly, and how do you create it? Little things such as establishing a customer appreciation program or offering personalized service build enormous goodwill, but more concrete efforts such as creating up-to-date databases and email lists also contribute. Goodwill is a melting pot of factors such as brand or name recognition, customer awareness, history, ongoing operations, and reputation. These are key players in goodwill, but there are many others as well, as shown here:

- Websites, Domain Names

- Trade Secrets, Recipes

- Customer List, Exclusive Supplier List

- Copyrights, Trademarks, Patents

- Licenses, Permits, Regulatory Approvals

- Contracts

- Production or Order Backlog

- Accreditations

- Developed Processes

- Proprietary Designs, Proprietary Know-how

- Customized Software Programs

- Step-by-step Training Systems

- Customized or Proprietary Databases

- Published Articles or Industry Press

- Employee Skills and Experience

Goodwill components are all intangible assets that create more value than the balance sheet would indicate. Take a company’s customer list. If it includes long-time repeat customers, not only does that represent a history of recurring revenue, but it illustrates future revenue. On top of that, a new owner can take that customer list and continue to build on the company’s existing reputation and use its associated word-of-mouth to their advantage in the future, hence, reduced risk. That adds incredible value to your business.

“Brand recognition, service or product reliability, and high customer satisfaction are distinguishing factors that add value.”

Relationships are key to goodwill because customers that stay with one company for some time are valuable. And if you have processes that keep track of these clients, the keys to your relationships with them, and your history with them, you’ve added even more value to your business. Proprietary databases can be a wealth of information for future buyers, further reducing their risk by giving them the tools they need to continue that goodwill and build on it.

Goodwill Has Now Become More Valuable Than Tangible Assets

Over the last few decades, intangibles such as goodwill, as an asset, have risen to as much as 84% of all enterprise value on the S&P 500, up from just 17% in 1975. Intangible assets are now worth more than tangible assets, and goodwill is a key part of that. How did that happen?

Look at it this way. You have a favorite coffee shop you visit every day. Why do you visit that one every day rather than its competitor? Chances are it’s not just because you like the product but because you appreciate the personalized or friendly service, the added bonuses or personal touches they add to their product or service, or their use of organic and planet-friendly ingredients. Or perhaps they contribute to a charity or community organization close to your heart. These are but a few of the ways businesses create goodwill, making your business more valuable than what your balance sheet would indicate.

In 2018, Amazon purchased Whole Foods for far more than its balance sheet said it was worth. Instead, Amazon paid out $13 billion. A full 70%, or $9 billion, of that price, was about goodwill. Generally, tech industries have the edge on goodwill based on their innovation, patents, etc., but Amazon shelled out on Whole Foods’ potential growth based on the goodwill they’d built. As a result, goodwill ended up accounting for 10% of Amazon’s total assets.

All that said, if you’ve created a solid foundation of goodwill that shows a buyer your company’s future growth is assured, your business then becomes more attractive than others like it, regardless of what’s listed on your balance sheet. Your processes, systems, and customer service are worth more than you think.

Beware the Shadow Side of Goodwill

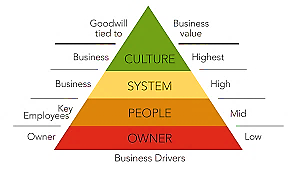

Just as goodwill can contribute greatly to the value of your business, so too can it detract from the value of your business. That may seem contradictory, but if the goodwill of your business is all, or mostly, attached to you as the owner, it increases the risk for a buyer.

This is called personal goodwill, and it should be avoided at all costs. Goodwill should be tied to your business systems and processes, to your management team and staff so that when you leave the business, your clients don’t leave with you. Personal goodwill has zero transferability, therefore, no commercial value. If your goodwill is tied more to you than your business, the odds are you’ll end up selling your business at a discount to make up for the risk a buyer will be taking.

Wrapping Up

An intangible asset such as goodwill when done well translates to tangible assets such as rising revenues and increasing market share, which reduces the risk of profitability loss for a buyer—provided the goodwill is attached to your business, not to you as the owner.

In the end, goodwill makes your customers feel good about your business, and both you and a new owner can use this to build on and ensure long-term success. Goodwill encourages loyalty and forgiveness in your customers, it sets you apart from your competition, it fosters future growth, and it reduces risk, thereby making your business highly valuable and potentially sparking a price war.

When you’re confident it’s time to sell, don’t let the sale of your business take your attention away from continuing to make your business profitable. Selling a business is time-consuming and tedious, so let an expert take care of the details for you. A mergers and acquisitions expert can even bring in many buyers at once and negotiate the best possible terms for you during the sale.

With decades of experience, Muise Mergers & Acquisitions Inc. can attract more interest, encourage a faster sale, and incite a higher price for your business. Call them now at (902) 456.6473 or send them an email and get the most for your business.